Market Commentary: The rediscovery of gold as an asset

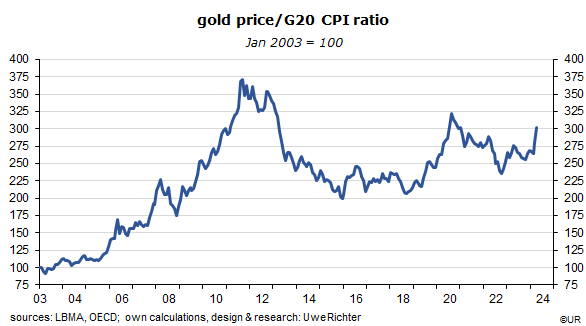

Since the beginning of the year the price of gold has increased by about 15%, both in dollar and euro terms – over the past ten years the dollar price of gold has gained about 80% while the euro price has been up no less than 130%. This was, by a wide margin, more than the loss of purchasing power during those periods and a good deal, despite the fact that the owners of the metal did not earn any interest, nor dividends, and that the safe storage of such a physical asset has cost them some money. In other words, gold has been a superior inflation hedge in recent decades.

But even in the very long term, it has performed strongly. Someone told me that in Rome, 2,000 years ago, it took a senator one ounce of gold to buy an elegant toga, and it still costs almost one ounce of gold today to get a bespoke (tailor-made) high-quality suit. I don’t know if this is just a nice story. In any case, no one can be sure that the gold price will keep rising – it fluctuates a lot which means it can also fall significantly. In the past this has happened for very different reasons: the discovery of new gold fields (the California gold rush in mid-nineteenth century), the conquest of gold-rich countries (by the Spanish conquistadores), or because real interest rates were high, and Inflation low, or because there had been peace for a long time – which reduced the need to hedge against the risks of life.

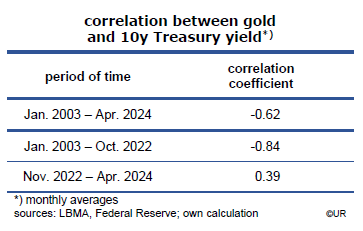

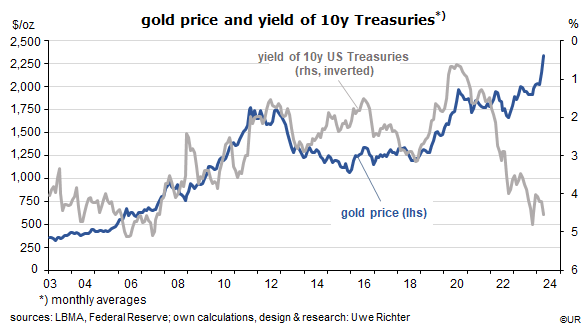

Gold has rallied for many years. The most important determinant of its price had been the yield of long-term US government bonds. When it rose, it drove up the so-called opportunity cost of holding gold, which became less attractive – the gold price fell. And vice versa. For several decades, the negative correlation was quite high – and significant. Gold and US Treasuries were seen as the main alternatives for financial investors who keep comparing cashflows and risk. If I look at the relevant time series, this narrative finally ended in November 2022. Since that month we can observe a slightly positive correlation – the narrative has clearly changed.

This means that the yield of US government bonds can now rise while the gold price goes up as well.

What happened? It looks as though American Treasuries have lost, or are in the process of losing, their status as the main alternative to gold in asset management. Because there are simply too many of them, the result of expansionary fiscal policies. US government debt will probably rise to 123% of nominal GDP in 2024, while the budget deficit is heading for 6% of GDP, despite strong economic growth which in normal circumstances reduces debt and deficit ratios. The comparable numbers for the euro area are 90% for government debt and 3.0% for the fiscal deficit of member countries. Financial investors are worried and feel that they are taken advantage of: pro-cyclical US fiscal policies are not sustainable and must end at some point. They seem to be diversifying their risks these days, by moving into gold.

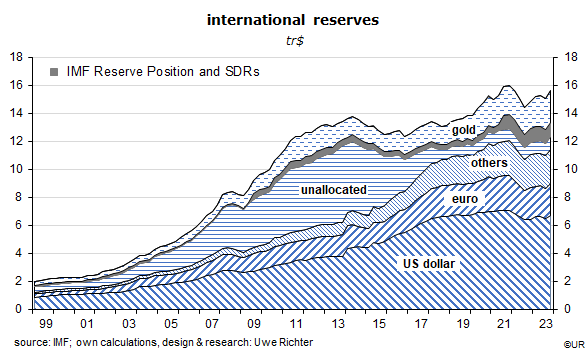

There is also a geopolitical factor at work: the United States increasingly regards China as its main competitor on global markets – it has launched, and has now intensified a trade war. In addition, a military conflict over Taiwan and the South China Sea has presently a probability of more than zero. The US are China’s enemy, while China is the main enemy of the United States. Why should China continue to underwrite US government debt?

Since October 2022 China has increased its gold holdings by 316 tons to 2,264 tons, a growth rate of no less than 16.2%. Almost simultaneously, the amount of US Treasuries held by Chinese private and government investors has declined from an average of 1.07 trillion dollars in 2020 and 2021 to just 767 billion dollars in March 2024 (-26%). Reliable and comprehensive data are not easy to come by, but it is safe to state that China is diversifying its international reserves. The balance on current account will once again show a large surplus – which means overall foreign currency and gold reserves continue to increase. The shift is from financial asset to physical assets – gold!

Overall, there are no indications that Asian gold purchases will end anytime soon; in addition to China, notably Singapore and gold-loving India are in the process of increasing their gold reserves – for economic and political reasons the gold price is therefore well supported. I wonder whether all this risk diversification is just the overture to a larger event, the general sell-out of dollar assets and a large depreciation of the dollar. But I also know that the US economy and its deep capital markets are usually more resilient than expected.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.