Market Commentary: European consumer prices are rising more rapidly – but outlook remains benign

Euro area consumer price inflation rates fall less rapidly than I had expected in the autumn of 2023. ECB analysts are now predicting an average rate of 2.5% y/y in 2024, followed by 2.2% in 2025 and 1.9% in 2026. In May 2024, inflation stood at 2.6% y/y, after 2.4% in April. Inflation is thus moving in the wrong direction, and it looks unlikely that the key policy rate, the interest rate on the deposit facility at the ECB, will be quickly cut further in the near term, after the 25 basis point reduction to 3.75% on June 6. The ECB makes it a point that their decisions are data driven.

Over the six months through May, German consumer prices had increased at an annualized rate of no less than 3.3% – the comparable figure for the euro area was 2.7%. Only if month-over-month consumer prices rise at a rate of about 0.1% can the predicted average annual rate of 2.5% be achieved, a tall order.

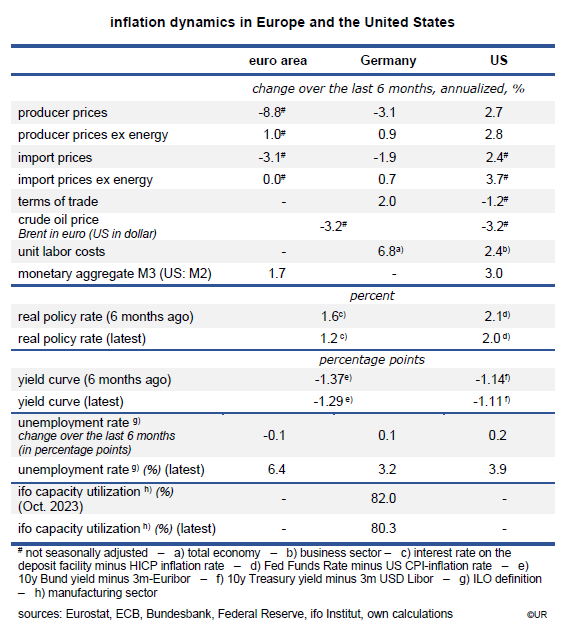

The inflation outlook is mixed. Import and industrial producer prices, important early indicators for consumer prices, remain in deflationary mode. Oil prices in particular are almost in a free fall – they have come down from 129 dollars per barrel in June 2022 to just 78 dollars. Goldman Sachs estimates OPEC’s unused capacities to be in the order of 6.5 million barrels a day, a result of weak demand (EVs!) and growing supply (shale!). This is good news for inflation but not so good for the climate.

Another piece of good news is the fact that European capacity utilization rates remain depressed. Producers therefore have a hard time raising their output prices. In the same vein, euro area unemployment is still high at 6.4% which is likely to keep wage inflation in check which in turn has a moderating effect on consumer demand and inflation.

In addition, monetary policies have de facto been tightened as a result of declining inflation rates – nominal policy rates have been unchanged (until yesterday) while inflation rates had come down quickly (until last April). In other words, real short-term rates have been up steeply. This has hurt interest-sensitive demand, for instance for durable goods and real estate. The inversion of the euro yield curve also continues to have a restrictive effect on final demand. Neither bank lending nor money supply M3 are growing at rates significantly different from zero.

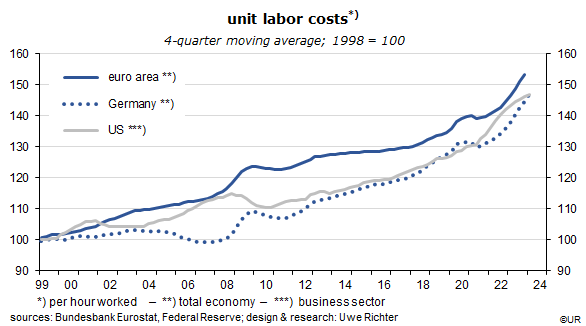

Now a look at less favorable developments with regard to future consumer price inflation: over the long run, services have become steadily more important. They account for about 70 percent of value added these days, were less affected by the global recession and were mostly not subject to international price wars. Since they are usually labor intensive, their prices are mainly driven by labor costs. During the five-year economic stagnation real wages had also more or less stagnated as well (one of the reasons why employment growth had been fairly brisk during that time). So there had been a pent-up need for wages to catch up with business income since about the middle of last year. Combined with the lack of skilled labor in some key segments of the European economy, it came as no surprise that wages and unit labor costs began to accelerate. This is the main obstacle for a near-term return of overall inflation to the ECB’s 2% target.

Overall, there is not much of a risk that European inflation might get out of control. We are experiencing a normalization, after almost one decade of below-target consumer price inflation. The euro area’s main problem is not inflation but anemic economic growth. Policy rates are clearly too high and should be cut by an additional 100 to 150 basis points over the next twelve to eighteen months. If the ECB is right about the trajectory of future inflation this should soon be possible.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.