Market Commentary: Negative social effects of German climate policies must be offset

To slow or stop climate change requires much higher prices for the emission of greenhouse gases. Since this has regressive effects on citizens’ income, comparable to a large increase of the value added and other indirect taxes, there is a conflict of political aims: progress in the fight against climate change would be at the expense of a more uneven distribution of real disposable incomes. This dilemma could be solved by an income tax code which reaches from negative rates for the poor to high rates for the better-off. Alternatively, social spending could be raised, taking into account the effects of higher prices for greenhouse gas (GHG)-intensive products and services, and thus of inflation, financed partly from the revenue the government gets from selling and auctioning-off CO2 emission certificates. The German Federal Office for the Environment (Umweltbundesamt, UBA) has published several path breaking studies on this topic (see UBA (2022)).

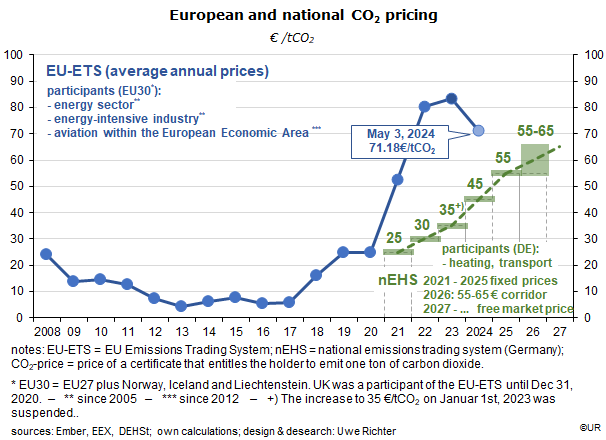

With the exception of the agricultural sector, all parts of the German economy are already participating in the system of CO2 emission certificates, if not yet at rates of 100 percent: EU-ETS takes care of the energy sector and industry, while buildings (heating) and mobility are covered by the national nEHS. Overall, certificates were used for 86 percent of Germany’s GHG emissions in 2022 (there are no more recent statistics). A significant share of the permits was given away free of charge to attenuate the massive structural changes brought about by the change of energy’s relative price.

Last year, the average price of a certificate was about 40 Euro per ton of CO2 emitted and provided the federal government (more precisely: the Climate and Transformation Fund) with revenues of €18.4 bn, or €200 per citizen, 0.45 percent of nominal GDP and 0.9 percent of private consumption. These are fairly modest numbers. The government aims to drive up the certificate prices over time and to make the use of GHG-intensive goods and services increasingly unattractive, in this way improve the climate and slow down the dangerous heating-up of the environment. The social, or true economic cost of issuing a ton of greenhouse gases is in the order of at least 200 euros. The road to an effective price of the certificates is still rather long.

To bring about those higher prices, the annual number of certificates will be reduced over time. At the moment, it is planned to cut them from a likely 280 million in 2024 in the nEHS to 180 million in 2030. I have no good sense of what will happen in the European EU-ETS system, but Germany’s share of auctioned certificates will be 107,1 million this year. If the price per ton is 45 euros, the 280 million certificates in nEHS will generate revenues of €12.6 billion for the climate fund, and an additional €8.6 billion from the EU-ETS, assuming that the price will be about €80, as in 2022 and 2023. This adds up to €21.2 billion, which translates into a year-on-year increase of a little more than 15 percent. Things move in the right direction, but not very fast. The pot which can be used for climate projects and the compensation of social hardship caused by the direct and indirect effects of high CO2 prices on inflation. At the end, when the structural change of the economy has been achieved, there won’t be any CO2 emissions to speak of any more.

To increase the incentive to reduce CO2 emissions, its price will have to go up year after year. This is essentially achieved by issuing fewer and fewer certificates. The UBA expects that their price will reach €200 by 2035 and €350 by 2045. How much this means in terms of revenues for the climate fund is not easy to answer because the future allocation of certificates in EU-ETS is uncertain and opaque: which country receives how many certificates – and which part will be issued free of charge? To limit the negative effects of the coming structural changes of the economy, it is likely that there will remain a large share of “free” certificates.

As mentioned above, the project has a regressive effect on citizens’ income. People who are well-off will be affected only moderately by the higher prices of CO2-intensive goods and services, but someone with a low income who must commute a long distance to work and lives in a poorly insulated home would have to face a large reduction of her or his real (post CO2) income. Here is a back-of-the-envelope, fairly realistic calculation of what this means financially for two different people:

– The first one earns €3,000 net per month, of which she spends €1,000 for gasoline and heating – which leaves her with €2,000 for other expenses and savings. If the rising prices for CO2 certificates cause the cost for driving and heating to go up by, say, 25 percent (to €1,250) she will be left with €1,750 for everything else, a reduction of her disposable income of 12.5%.

– The second one brings home €10,000 net per month and pays €1,500 for CO2-intensive goods and services; he has €8,500 for the rest. If prices for heating and driving rise by 25 percent, his remaining income goes down €1,875 to €8,125, or by just 4.4%.

The message: a climate policy which is to be both effective and fair requires a financial compensation for low income-households. One solution would be to return the entire amount of state revenues from selling and auctioning CO2 certificates to citizens. This translates into €250 per year and person if it is done on the basis of “the same amount for everyone”, for grandmothers, unemployed people, children, workers, and millionaires. For the poorer part of the population this would be a small but welcome additional income, for the better-off it would not make a difference. Many economists favor this approach, but it is not really fair.

In addition, there is the problem that climate and social policies would be mixed up. According to a time-honored economic policy principle, named after the Dutch economist Jan Tinbergen, each economic goal needs at least one linear independent instrument. In our case, the goal of reducing the emission of CO2 is best served by raising the price of CO2 certificates. On the other hand, the goal of achieving a fair distribution of real incomes is the task of fiscal policies, of adjusting government revenues and spending. A part (or all?) of the money that arrives in the climate fund can be distributed back to the population, but not on the basis of “the same amount for all” but rather according to the government’s general distributional principles. As a general fiscal policy rule, the revenue and spending sides of the ledger should be strictly separated. For policy makers there is the temptation to use the fund for useful climate projects such as subsidizing heat pumps, solar panels, district heating, energy storage or the electricity grid. If the price of CO2 certificates is high enough, such micro-economic industrial policies would not be necessary. The price mechanism on its own would bring about the desired results, and there would not be another political battlefield. Keep it simple: high CO2 prices and more spending on social policies.

One aspect that needs watching is the likely reduction of demand for certificates (and of CO2 emissions), as a result of rising prices. After all, this is the task of this instrument. In the end, energy efficiency will increase a lot, and renewables will have replaced fossil fuels. Good for the climate.

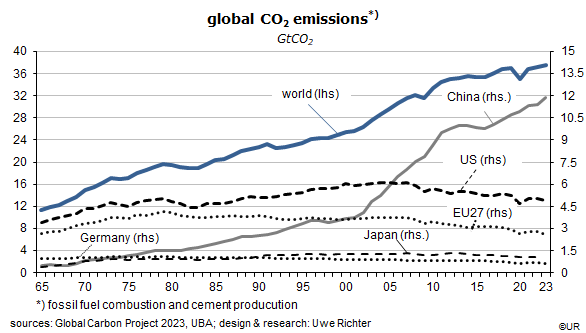

There are two other important aspects which have to be kept in mind: Germany may go 100% CO2-neutral over time, but it hardly matters in a global context. Its population is just 1 percent of the total and its GDP is in the order of just 3 to 4 percent of the world’s GDP (depending on whether I use market or purchasing power exchange rates). Policy makers must urge the EU to pursue a common climate, ie, CO2 strategy and look for allies in the rest of the world (like UK, US, Canada, and Japan). We could then be talking about 15 percent of the global population, and more than half of the world’s GDP – this would no longer be a quantité négligeable.

Moreover, policy makers must prevent the relocation of production and jobs to countries which are less ambitious about climate targets – it requires a border tax: I had discussed this in a previous post (“CBAM – the new European border tax“). To be sure, this may not be allowed to morph into another bureaucracy monster.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.